Summary

- A sound credit profile should provide for a valuation premium.

- The 7%+ dividend looks very sustainable.

- The recent credit update provides a green light to start to average into the shares.

Investment Thesis

Headquartered in Pittsburgh, Pennsylvania, F.N.B. Corporation (FNB) is a diversified financial holding company for First National Bank of Pennsylvania. FNB provides a wide range of financial services across the Atlantic seaboard through its 350+ bank branches. FNB has four main reported business segments: (1) Community Banking, (2) Wealth Management, (3) Insurance, and (4) Consumer Finance. With over $37 billion in assets and a leading deposit market share position in multiple MSAs located throughout its six state footprint, FNB is a force to be reckoned with.

While FNB is currently trading at a discount to peers, due to lower capital levels versus peers, I would look toward its sound credit policy and sustainable 7%+ dividend yield for reasons to invest today. FNB has a near sterling credit track record that I think should lead to greater earnings stability through this recession and could regain some of the multiple degradation over the past 3 years.

My current bullishness is built on the current valuation gap that I think should narrow over the next year driving outperformance and better risk adjusted returns. FNB has historically had a management team that is focused on credit first and growth second. While that might be frustrating in times of economic prosperity, it should serve the bank well for economic downturns like today.

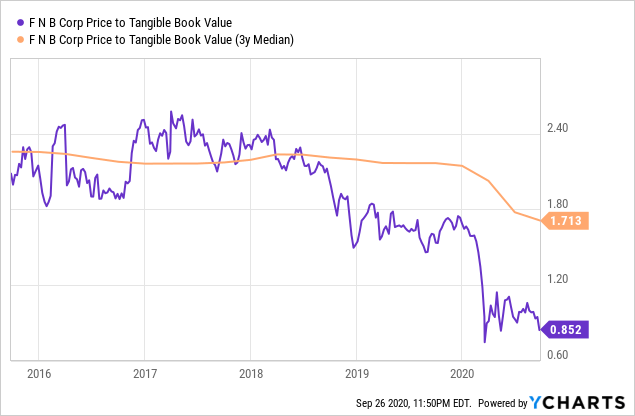

Data by YCharts

Data by YChartsAs one can see from the chart above, FNB typically trades at near 2.0x price to tangible book value in good economic times. Given that we are in a recession, I would guess that valuation should be closer to 1.25x per share. Should FNB trade back up to that range (the 1.25x), it would mark a 48% upside in share price along with the 7% dividend yield - setting the stage for 55% upside return potential.

Revenue Outlook

Since the beginning of the pandemic to the end of the second quarter, FNB had originated $2.6 billion in PPP loans aided by its internal digital operating platform. Management touched on this success during the second quarter call, in particular, FNB had the ability to filter and support requests more efficiently providing better service especially compared to large bank competitors. As a result, roughly 20% of all processed and approved applications were from non-bank customers. From management's commentary, it sounded like PPP started as a means to support existing clients but should open the door to call on these new customers in the near future.

When looking at second quarter results, it's clear that average loans jumped significantly (+$2.8 billion) or 12.5% from last year, primarily due to PPP loans. However, net interest income of $231.1 million was down from the first quarter as the reported net interest margin (NIM) decreased by 26 basis points to 2.88%. The decrease was driven by sizable loan yield compression from the tough interest rate environment and the addition of low yielding PPP loans.