- Earnings expected to decline in 2020 due to NIM shrinkage and higher provisions charge.

- Loan growth expected to continue but at a lower rate due to new rent regulations in New York.

- Quarterly dividend expected to be maintained at $0.11 per share, implying dividend yield of 2.63%.

Loan growth and provisions charge of Northfield Bancorp (NFBK) are likely to be negatively affected by new legislation in New York. In addition, the company's net interest margin is expected to be negatively impacted by Fed's 2019 rate cut by the mid of next year. Due to these factors, NFBK's earnings are expected to decline in 2020.

Rent Regulations to Affect Loan Growth

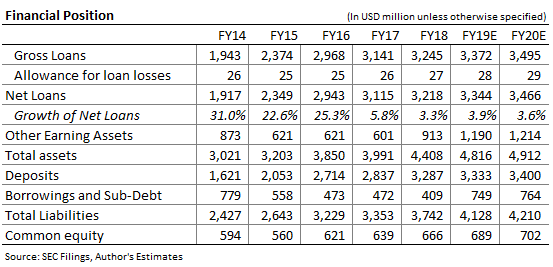

NFBK's main area of focus is multifamily real estate loans, with the segment making up 60% of total loans at the end of June 2019. Unfortunately, the outlook for demand of multifamily loans is bleak in New York, where NFBK operates (NFBK's multifamily loans have collateral located in New York, New Jersey and Massachusetts). The State of New York enacted legislation in the mid of 2019 to increase restrictions on rent increases in a rent-regulated apartment building. I expect the legislation to dampen demand for NFBK's credit product. Consequently, I'm expecting the company's loan growth to slow to 3.6% year over year in 2020, as shown in the table below.

Net Interest Margin to Face Lagged Pressure from Interest Rate Cut

The 50bps rate cut by the Fed in 2019 till date is expected to have a mostly immediate impact on almost 65% of NFBK's interest bearing deposits. On the other hand, the effect on yields will be more lagged due to the high proportion of fixed rate loans. Consequently, the rate cut is expected to have a positive impact on net interest margin, NIM, in the short term. The table below, which has been taken from the 2QFY19 10-Q filing, shows the management's expectations of the impact of rate cut on net interest income. According to the management's estimates, a 100bps dip in interest rate will lead to an increase in net interest income of positive 0.35% in the next twelve months. In the second year, the rate cut will lead to a decline of 4.36% in net interest income.