Summary

- Earnings are expected to decline due to a reduction in net interest margin and growth in non-interest expense.

- Loan growth is also expected to slow due to the overall slowdown in the economy and the resultant dip in demand for credit products.

- MPB is expected to pay $0.72 as dividend in 2020, implying a dividend yield of 2.89%.

- Valuation analysis suggests slight price upside.

Earnings of Mid Penn Bancorp (MPB), a bank holding company, are expected to decline in 2020 on the back of a shrinkage in net interest margin and growth in non-interest expense. Due to the earnings decline, it is expected that MPB will skip the special dividend next year, and pay $0.72 as regular dividend per share. This dividend expectation implies a yield of 2.89%.

Loan Growth to Slow

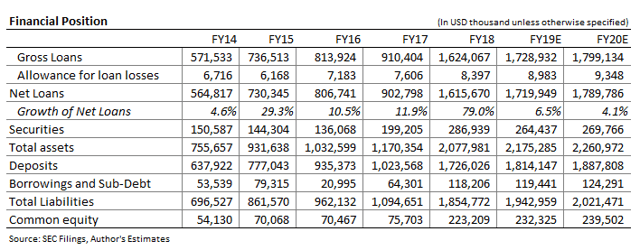

MPB's loan growth is expected to slow in 2020 due to the overall economic slowdown that will affect demand for loan products in the economy. MPB focuses on the commercial real estate segment, CRE, which made up more than 60% of total loans as at the end of June 2019. As the CRE segment responds more quickly to prospects of economic slowdown than the residential real estate or consumer loans segments, MPB faces greater risk than peers focusing on other segments. I expect MPB's loan growth to slow to 4.1% in 2020. The table below shows estimates for loans and other key balance sheet items.

Earnings to Suffer From Net Interest Margin Reduction

Earnings to Suffer From Net Interest Margin Reduction

MPB has a high amount of debt that the company previously took to finance loans and its First Priority Bank acquisition. In fact, borrowings made up 15% of MPB's total interest expense in 2QFY19. Due to the debt, MPB's cost of funds is expected to remain high and downward sticky. The notes for acquisition of First Priority bank expire in 2025, are non-callable in the first five years and bear a high interest rate of 7.0%, according to disclosures in MPB's financial statements. Meanwhile, the notes issued in 2017 carry a high fixed rate of 5.25% for the first five years, i.e. till 2022, after which their rate becomes floating. These notes expire in 2028. Notes issued in 2015 carry a high fixed rate of 5.15% for the first five years, i.e. till December 2020. I expect the 50bps Fed rate cut, and the stickiness of borrowing cost, to result in funding cost declining by just 4bps in the second half of 2019 before stabilizing. I'm not expecting any further Fed rate cut.

I expect the 50bps Fed Funds rate cut in 2019 till date, and the competition in the CRE segment, to lead to a 25bps dip in yields in the remainder of 2019, followed by 3bps decline in each of the first two quarters of 2020. As a result of the lower funding cost and yield expectation, I expect net interest margin to decline by 15bps in 2020. The table below summarizes the yield, cost, and margin estimates.