Summary

- PNC Financial Services is a very conservatively run bank which has strong and strict underwriting standards.

- The bank is well capitalised and has a management that is future-focused, which gives confidence that the firm is headed in the right direction.

- Interest rates remain at historical lows meaning that those investing in the banking sector are purchasing at the low point in the cycle.

- The bank plans to return significant amounts of capital to shareholders, which should boost total returns.

- Looking for more? I update all of my investing ideas and strategies to members of All Weather Fund. Get started today »

PNC Financial Services (PNC) is a solid player in the banking sector. PNC is very conservatively managed with a diversified loan book that is tightly underwritten. Management is astute and future-focused and has a long-term orientation with their vision for the business. The recent investment by Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) is a testament to these factors. While generally not on the radar of most investors, PNC is ranked 9th on the list of the largest banks in the United States by assets and is ranked 6th largest by deposits in the United States making this an interesting play.

PNC has been a major beneficiary of banking consolidation in the United States. During the financial crisis of 2007-2008, PNC acquired National City Corp. for $5.2 billion in stock. The deal helped PNC double in size and become not only the 6th largest bank in the United States by deposits but also the 5th largest by branches. This has allowed PNC to really expand its reach and scale.

In today's market, the top large banks, those most comparable to PNC, are being valued in the 1.5 to 2 times book-value range. Those banks, like U.S. Bancorp (NYSE:USB), have very low levels of non-performing assets, have returns on equity of 10% or more, and have a healthy mix of revenue from both interest income and non-interest income. These banks tend to operate with lower cost structures, creating positive operating leverages to support profits no matter how quickly or slowly the Federal Reserve raises interest rates. PNC's valuation at 1.4 book-value is a testament to the quality that the market assigns to the business of PNC.

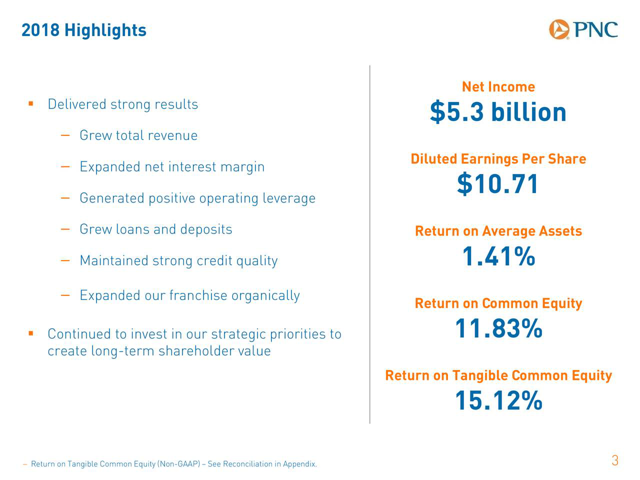

Source: 2018 Annual Report

PNC continues to post excellent numbers on its financials. It earned more than 1.41% on its average assets and 15.12% on tangible common equity which is outstanding for a bank.