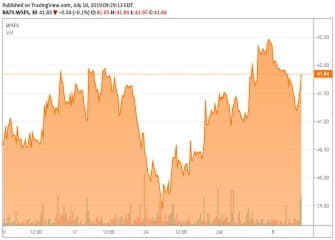

WSFS Financial (NASDAQ:WSFS) reports higher levels of provision for loan losses and concurrent charge-offs in 2Q 2019 due to occurrence of two events impacting Commercial and Industrial relationships.

$5.9M loan to a managed health care facility and $5.7M loan related to a refinery are included under nonperforming assets.

The company expects elevated net charge-offs totaling between $12M-$14 for 2Q19; total credit costs between $13M-$15M.

The company expects overall credit quality metrics to be consistent with recent quarterly trends, excluding the impact of these two C&I relationships.