Summary

- AmerisourceBergen is a pharmaceutical distribution company that has seen solid earnings and revenue growth.

- The company does have a deal with the CDC to handle the distribution of COVID vaccines to independent pharmacies.

- The stock has pulled back over the last few months but that has put it at support.

- Looking for more investing ideas like this one? Get them exclusively at The Hedged Alpha Strategy. Get started today »

AmerisourceBergen (ABC) plays an interesting role in the pharmaceutical industry. The company doesn’t make any pharmaceutical products, but rather it sources and distributes them.

Given the current state of the industry and the importance of getting the COVID vaccines distributed efficiently, AmerisourceBergen could play a key role. And yes, the company has reached an agreement with the CDC to aid in the distribution of vaccines to independent pharmacies.

While AmerisourceBergen’s role in vaccine distribution should help the company’s bottom line, the company was doing pretty well even before the current health crisis. Over the last three years the company has seen earnings grow at a rate of 10% per year while revenue has grown by 8% per year. The company reported fourth quarter 2020 results back at the beginning of November and the company saw earnings grow by 17% while revenue increased by 8%.

The company is set to report Q1 2021 results on February 4 and analysts expect earnings to grow by 10.2% over Q1 2020. Revenue is expected to increase by 5.5% for the quarter.

The management efficiency indicators for AmerisourceBergen are mixed. The return on equity is extremely high at 175.5% while the profit margin is low at 1.1%. As for the current valuations, the stock appears to be undervalued based on a trailing P/E of 13.9 and a forward P/E of 11.7.

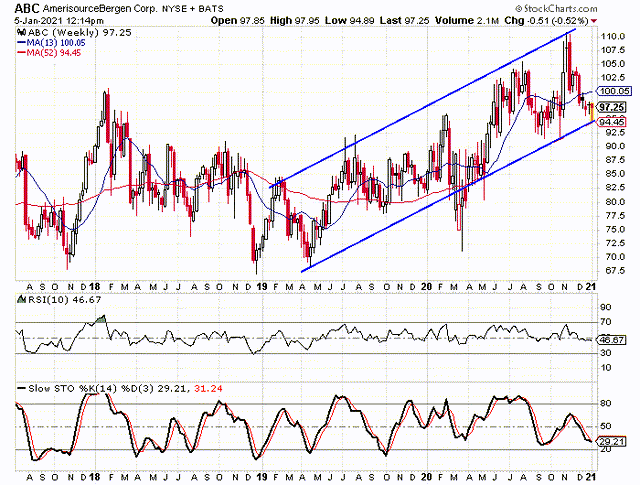

The Stock has been Trending Higher within a Trend Channel

AmerisourceBergen saw its stock bottom at $66.86 back in December ’18. Since then the stock has been trending higher in cycles and a trend channel defines the various cycles. The stock did drop below the lower rail of the channel for a few weeks back in the first quarter of 2020, but I have described that period as a black swan event. It caused many stocks to break patterns that had been in place for years. Many of the patterns have redeveloped now that a sense of calm has returned to the market.

What we see on the chart currently is that the stock is down near the lower rail of the channel and the 52-week moving average. The moving average and lower rail are right on top of one another—so much so that you can’t even see the moving average right now.

The stock bounced off of its 52-week back in October and then rallied by 20% in only two weeks to hit the upper rail of the channel.

You can also see that the weekly stochastic indicators are approaching the same level where they bottomed out in the fall. The indicators haven’t reached oversold territory since October 2019. When the stock dropped in Q1 of last year, the indicators never even dropped below the 30 level. The stock rallied over 40% in three months after that low, but I have to reiterate that circumstances were out of the ordinary back then.