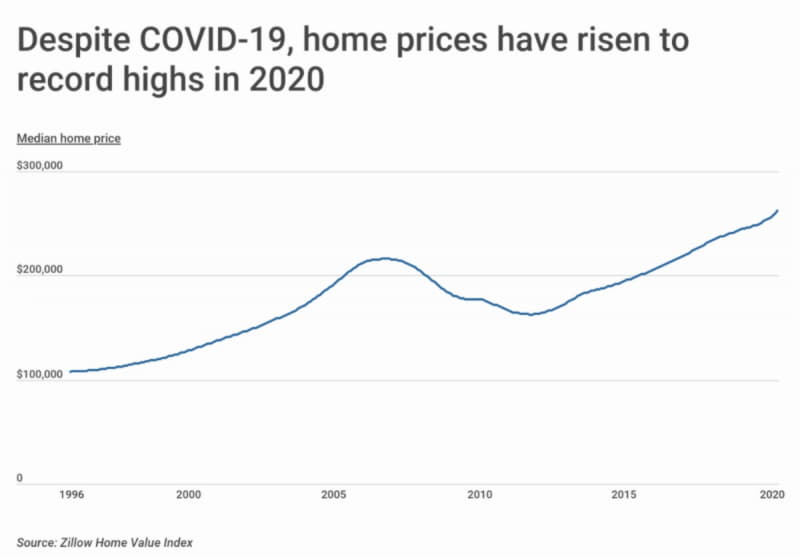

Despite the current COVID-19 recession and the initial drop in home sales, the national housing market expanded significantly in 2020. According to a report by the Joint Center for Housing Studies of Harvard University, record low home inventories in tandem with historically low mortgage interest rates will most likely ensure home prices continue to rise.

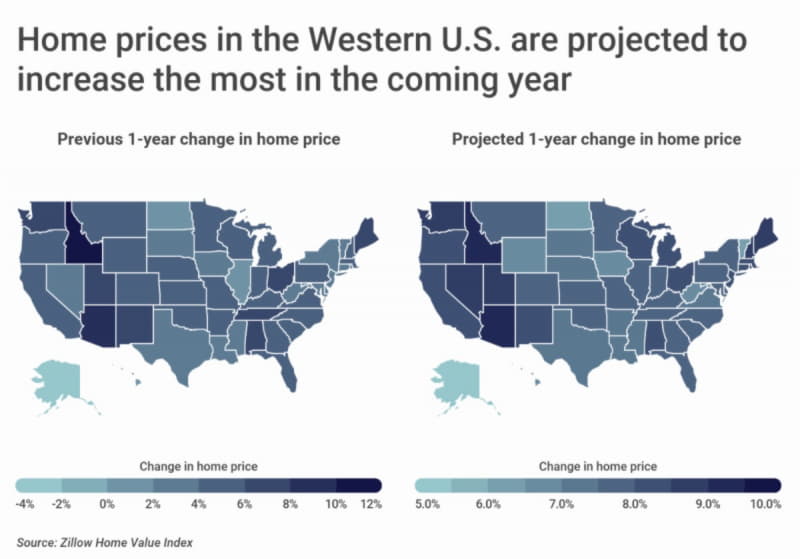

Data from Zillow shows that the national average monthly home value index for 2020 was 4.7 percent higher than in 2019. Yet some housing markets have significantly exceeded this growth. A comprehensive look at state-level data and data from the nation’s 95 largest real estate markets reveals that home prices in the Western U.S. are projected to increase more than in any other region over the next 12 months.

Younger adults, including millennials, drove much of the increase in home sales during 2020, with millennials making up the largest share of home buyers at 38 percent. Higher earners—often less affected by detrimental COVID-19 economic and financial repercussions—also accounted for higher home sales in 2020.

According to statistics from the National Association of Realtors, the median household income of first-time buyers in 2020 was $80,000; the median household income of repeat buyers was $106,700. By comparison, the median household income in 2019 was $68,703. These higher earners also typically work in industries that allow for remote work, which, in conjunction with historically low mortgage rates, incentivizes larger home purchases outside of urban centers.

In addition to strong financial drivers, experts attribute several other factors to the uptick in home buying since the May 2020 trough: delayed purchasing of homes due to the pandemic, an increased need for larger spaces to accommodate parents working from home and children attending school virtually, a departure from multi-family buildings to single-family homes to mitigate exposure to the virus, and an increased ability to attend virtual home tours and close on a purchase virtually.

To find the hottest real estate markets of 2020, researchers at Construction Coverage analyzed data from Zillow on the largest 95 real estate markets in the U.S. They created a composite score of each city based on the following metrics:

- Previous 1-year change in home price (the percentage by which median home price increased or decreased over the last 12 months)

- Median price cut (the median percentage by which the final selling price was reduced from the original listing price)

- Median days on the market (from listing to pending)

- Projected 1-year change in home price (the percentage by which median home price is expected to increase or decrease over the next 12 months)

At the state level, certain Western states like Idaho, Arizona, Washington, and Utah experienced some of the largest changes in price since 2019, and are also forecasted to see the biggest increases in the coming 12 months. On the contrary, Alaska and parts of the Great Plains region saw limited price growth in 2020, and prices are expected to trail the national average in the months ahead.

At the city level, Western locations are also disproportionately represented among the nation’s hottest real estate markets. In these areas, prices are growing quickly, homes are moving off the market fast, and buyers are typically paying very close to asking prices.

The analysis found that from 2019 to 2020, the median home price in the Philadelphia metropolitan area increased by 4.3% to $258,958. Over the next 12 months, the median home price is expected to increase by another 6.3%. Here is a summary of the data for the Philadelphia, PA metro:

- Composite score: 45.00

- Median home price 2020: $258,958

- Previous 1-year change in home price: 4.3%

- Median price cut: 2.7%

- Median days on the market: 18

- Projected 1-year change in home price: 6.3%

For reference, here are the statistics for the entire United States:

- Composite score: N/A

- Median home price 2020: $254,404

- Previous 1-year change in home price: 4.7%

- Median price cut: 2.4%

- Median days on the market: 21

- Projected 1-year change in home price: 7.9%

For more information, a detailed methodology, and complete results, you can find the original report on Construction Coverage’s website: https://constructioncoverage.