Summary

- Investors have still not fully discounted the negative effect higher corporate tax rates and U.S. price controls on drug prices will have on Merck in 2021-22.

- Johnson & Johnson's diversification away from traditional pharmaceuticals is very desirable going into 2021.

- In the end, JNJ's businesses should continue to eke out gains next year, while Merck's may stagnate or even fall into 2022.

- I propose a long/short trade between the two to eliminate market direction risk, in today's overvalued stock market.

I have talked about the bullish long-term setup for Johnson & Johnson (JNJ) this year on Seeking Alpha several times. Since my June story, the diversified health care giant has outlined a 6% total return. Then during late summer, I explained my bearish views of Merck (MRK), with the expectation a President Biden and Democrat-led Congress in early 2021 will bring new rules and laws negatively affecting pharmaceutical industry profitability. Since that effort, Merck has actually declined in price against a 12% gain for the S&P 500. While both companies have remarkably similar margins/returns, balance sheets and valuation multiples, two major differences in their pharmaceutical focus and momentum trading patterns seem to argue Johnson & Johnson will be the clear top choice for 2021. Why not play up the differences in a long/short design, shooting for a 10-20% net return the next 6-12 months?

I have written articles during 2020 about a handful of big pharmaceutical businesses, including both buy and sell suggestions. My story in August went through the proposition of a successful long/short spread trade between AbbVie (ABBV) long and Gilead (GILD) short, mainly offsetting high vs. low growth projections. It ruffled the feathers of Gilead bulls, but the trade has continued to churn out nice, low-risk profits for investors wanting to avoid the market-direction risk of a long-only position. So far, AbbVie has generated a positive +10% total return vs. Gilead’s negative -12% total return from publication of my arguments.

I have written articles during 2020 about a handful of big pharmaceutical businesses, including both buy and sell suggestions. My story in August went through the proposition of a successful long/short spread trade between AbbVie (ABBV) long and Gilead (GILD) short, mainly offsetting high vs. low growth projections. It ruffled the feathers of Gilead bulls, but the trade has continued to churn out nice, low-risk profits for investors wanting to avoid the market-direction risk of a long-only position. So far, AbbVie has generated a positive +10% total return vs. Gilead’s negative -12% total return from publication of my arguments.

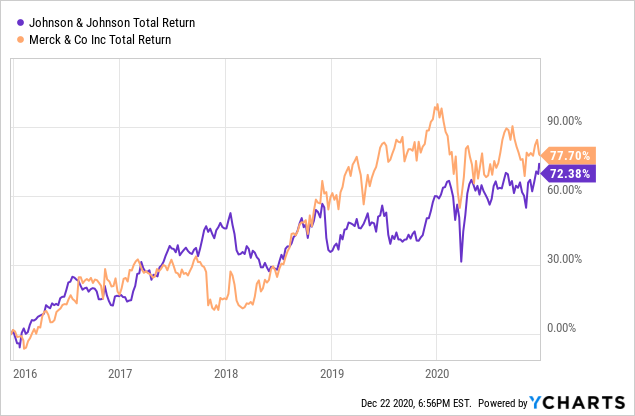

In many respects during 2020, the JNJ/MRK offset idea is working exactly like the ABBV/GILD design for net performance. Let’s review the proposition. On the total return charts below, including dividends, Johnson & Johnson and Merck have almost identical gains around +75% the last five years.

Over the past three years, Merck has been the obvious winner of the two alternative health care names.