Summary

- The company is off the back of a set of very impressive Q3 numbers.

- Ecommerce sales continue to impress.

- The firm has never been as profitable. We expect this momentum to continue into 2021.

- Looking for a portfolio of ideas like this one? Members of Elevation Code get exclusive access to our model portfolio. Get started today »

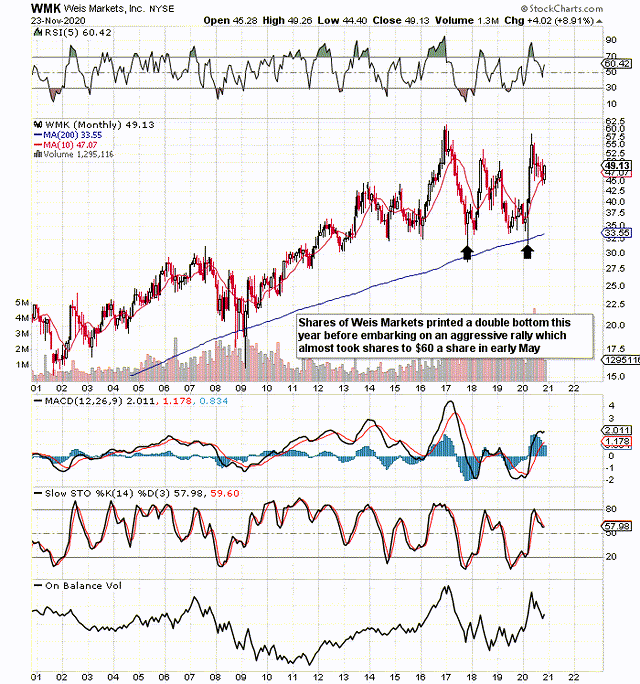

We wrote about Weis Markets (WMK) last December, where we stated that the stock had plenty of potential due to a potential double bottom reversal pattern being in play. Furthermore, despite earnings growth at the time being under pressure, free cash/flow numbers remained elevated and buying volume was strong. As we can see on the long-term chart below, we can say that we did indeed get that bottom, which resulted in an aggressive rally in the share price from mid-February to early May of this year.

We find that major reversal patterns or also continuation patterns have more possibilities of playing themselves out when viewed on the long-term charts. The reason being that information can be compressed, which enables us study much longer time periods. It is no coincidence also that shares were unable to break through the highs we witnessed back in the tail-end of 2016. This brings a possible double top in play, which is the mirror opposite of the double-bottom reversal. To see if this potential topping pattern has any possibility of playing itself out, we like to look at Weis' key profitability metrics and how the firm has been looking after its shareholders, plus also its present valuation. Trends in these three key areas can inform us on whether a bottom is close or if indeed something more sinister has begun.

Firstly, the company is just off the back of announcing its third-quarter numbers. Top line sales increased by over 14% in the quarter to hit $1 billion, and net income increased by a whopping 119% to hit $31.3 million for the quarter. Although shares are up close to double-digit percentages since the earnings release, we actually would have expected shares to be trading well past $50 a share at this stage. We state this because the S&P for example is up almost 300 handles since November 2, so equities in general have been enjoying a strong tailwind. Furthermore, ecommerce sales at the company continue to grow at record levels.