Summary

- II-VI is a leading engineered materials and optoelectronics manufacturer with a strong blue chip customer base.

- With the recent Finisar acquisition alongside strong tailwinds from 5G and 3D sensing, there is a significant room for upside.

- Valuation is compelling, and I see at least 20% upside from these levels.

Introduction and Investment Thesis

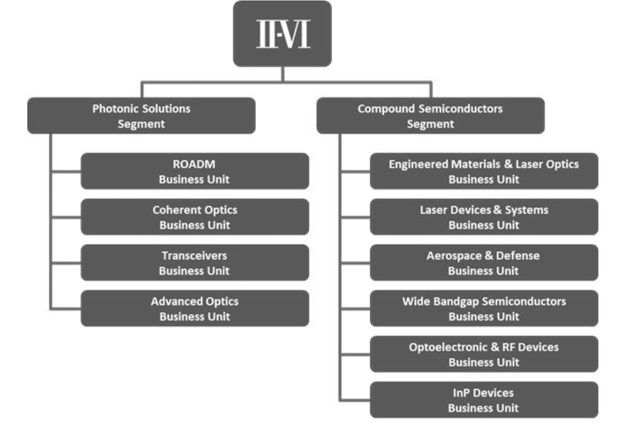

II-VI (NASDAQ:IIVI), founded in 1971 and based in Pennsylvania, is a provider of novel engineered materials and optoelectronic components used in a variety of end markets, including defense, aerospace, telecommunications, and consumer electronics. Due to the strength of the company's product offerings and differentiation in the marketplace, the company has been able to win a blue chip set of customers, including Ciena (NYSE:CIEN), Cisco (NASDAQ:CSCO), Corning (NYSE:GLW), ASML (NASDAQ:ASML), Ford (NYSE:F), Lockheed Martin (NYSE:LMT), and STMicroelectronics (NYSE:STM). The general corporate structure and segmentation of the company are illustrated below:

A big part of my bullishness on the company is related to the company's acquisition of Finisar in 2019. The fruits of which are only beginning to be truly recognized. Not only does this give the company a strong leader in the market for fiber optic subsystems and components, but also benefits both the top line and the bottom line, which I illustrate in the Financial Summary section below. The overall integration is going well with the company delivering $80 million of synergies in the first 12 months compared to their target of $35 million. Additionally, although there are some signs of a near-term demand slowdown, 5G rollouts and other deferred network upgrades due to COVID-19 should drive strong growth in the medium to longer term for Finisar's core optoelectronics segment.

3D sensing is another major growth area for the company and is another core part of my investment thesis. This is driven by the growing consumer demand and manufacturer requirements for 3D sensing capabilities on their devices. The upcoming 5G roll-outs should also catalyze a smartphone refresh cycle that will drive sales of devices with 3D sensing capabilities. With the company reporting growth here of 200% year over year and over 160% organically, I believe the company is performing well in this segment.