Summary

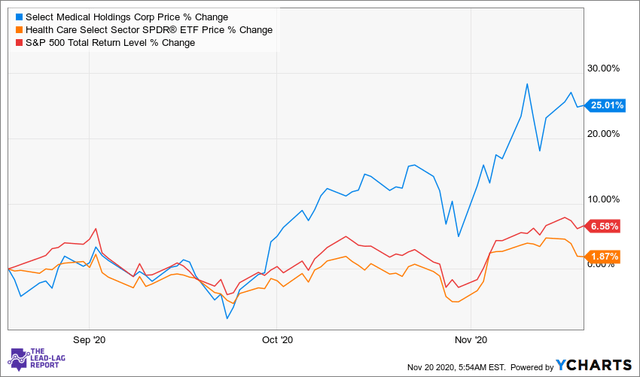

- Since its earnings report, it has broken out from the healthcare sector in the broad market.

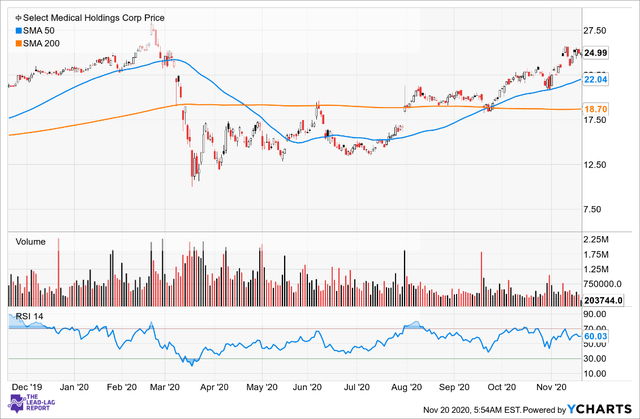

- Trading above its 50- and 200-day averages.

- Issued guidance that full-year results will be close to original estimates from the end of 2019, even with the effects of COVID-19.

- I do much more than just articles at The Lead-Lag Report: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

A hospital bed is a parked taxi with the meter running. – Groucho Marx

"Pfizer’s COVID vaccine news sent its stock price soaring, but it really wasn’t able to lift the healthcare sector with it. COVID-related gains could be limited mostly to the biotech sector as the rest of healthcare is still facing some political uncertainty,” as explained by our subscription service, The Lead-Lag Report, but Select Medical Holdings Corporation (NYSE:SEM) is an exception to that theory. SEM is a healthcare company that owns and operates critical illness recovery hospital, rehabilitation hospitals, and outpatient rehabilitation clinics across 46 states. The stock has been trading at a strong position for the past 100 days. It has outperformed the broad market and its sector, as based on the S&P 500 Index and the Health Care Select Sector SPDR ETF (XLV).

The stock is trading above its 50- and 200-day moving averages. While the 50-day average has been positively sloped since August, which makes the technical position even stronger, the 200-day average recently turned upward over the past 30 days. The stock is in an accumulation phase, as shown by the accumulation on up days versus down days.

On a fundamental basis, the company reported 3rd quarter earnings on September 30, 2020, which showed solid growth in 2 out of their 4 business units and a stabilization in the other units. “Income from operations increased 27.0% to $156.1million for the third quarter ended September 30, 2020, compared to $122.9 million for the same quarter, prior year. Income from operations included a net reduction of $1.2 million related to payments received under the Provider Relief Fund,” as stated in the earnings release. So, even though SEM had to return a portion of the money from the CARES Act due to reclassification, they still managed to build their income from operations. EPS was $0.57 on a fully diluted basis for 3Q20 compared to $0.23 for the same quarter, prior year. Meanwhile, adjusted EPS was $0.56 on a fully diluted basis for 3Q20 compared to $0.33 for the same quarter, prior year. So, they have shown growth despite tough conditions of government restriction on capacity of indoor spaces.