Summary

- Teva's revenues disappointed, but this was likely due to COVID-dependent market volatility.

- In contrast, margins were up significantly, which should benefit long-term shareholders over time.

- The key issue holding back the stock right now is the opioid litigation, which is unlikely to be solved quickly.

The quick take on Teva's (TEVA) Q3/20 results (slides - transcript): Revenues disappointed a bit, but cost savings saved the day. And everybody is sick of waiting for the opioid settlements which are unlikely to be finalized anytime soon.

Why did revenues disappoint? - Mainly for three reasons: Early in the year, customers purchased tons of OTC drugs like paracetamol in advance, which weighed on demand in Q2 and Q3. Second, Ajovy remains a bit slow to ramp. This is mainly because it did not have an autoinjector device early in the launch. While this is now available, COVID clearly makes sales reps promotion more difficult. Third, during lockdowns people simply go less often to doctors and pharmacies, which dampens demand for generics in general.

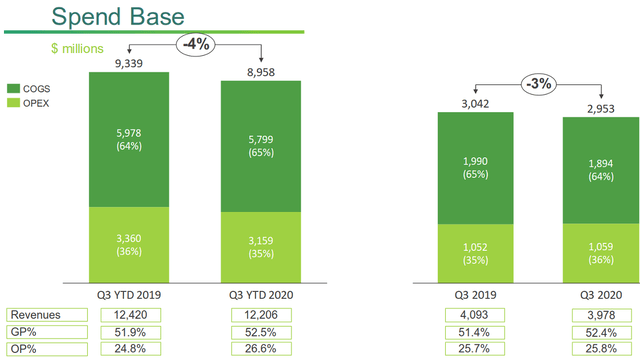

On the positive side, cost control was excellent. Despite lower sales YoY, margins were higher. Since COVID will likely pass within a few quarters, I would not be too concerned about minor sales decreases and sales volatility. On the other hand, the lower spend base will remain and will benefit shareholders for many years to come.

As a result of continuous good free cash flow generation, net debt is now down to $23.8B, a reduction of over $10B since the present management took over three years ago.

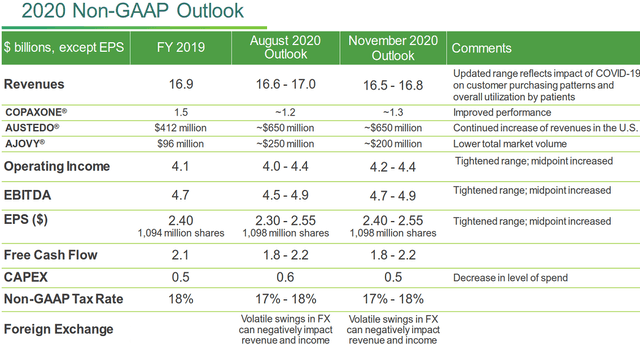

All this is reflected in Teva's updated guidance:

The midpoint of the revenue guidance is down by $150m compared to three months ago. $50m of this are due to Ajovy. Since Copaxone outperformed expectations, the reduced sales guidance must effectively be due to an underperformance of generics, a COVID effect. At the same time, however, the midpoint of the EBIT and EBITDA guidances increased by $100m. EPS is now projected to reach at least last year's level, despite more shares outstanding and the pandemic.