Summary

- Corteva's first half of the year was very decent, and the company reported strong free cash flows.

- Due to seasonal effects, we shouldn't expect much from the second semester based on Corteva's full-year guidance.

- Corteva's expected growth trajectory remains intact, and the company is still attractively priced.

- Volatility has boosted the option premiums and I will be looking to write an out of the money put option in an attempt to establish a long position further down the road.

- Looking for a helping hand in the market? Members of European Small-Cap Ideas get exclusive ideas and guidance to navigate any climate. Get started today »

Introduction

After having checked DuPont de Nemours (DD) and not being impressed with its share price and current valuation, I wanted to have a closer look at its historical spinoffs as well. Corteva (NYSE:CTVA) was spun out from DuPont in 2019.

The cash flows remain strong

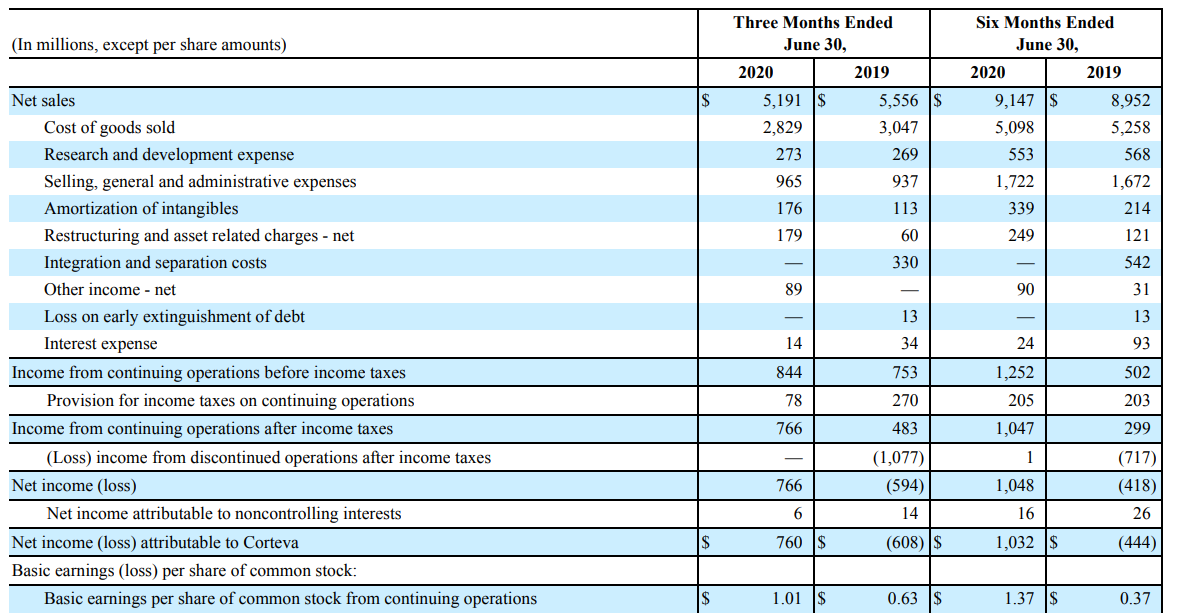

In the first half of the year, Corteva reported total revenue of approximately $9.15B, an increase of just over 2% compared to the first half of 2019. It was a nice surprise to see a revenue increase in the first semester as the first quarter really saved the day considering the Q2 revenue fell by almost 7%.

Source: SEC filings

Fortunately Corteva also was able to reduce its COGS by the same percentage during the second quarter, and although other expenses increased, Corteva was still able to report a higher operating income (up $91M compared to Q2 2019). Hardly a surprise as the Q2 2019 results included about $330M of separation expenses related to Corteva being spun out from DuPont. The net income in Q2 attributable to Corteva shareholders came in at $760M, which is approximately $1.01/share. That’s much higher than expected thanks to the low tax bill (an average tax rate of 9%).

Looking at the financial results in the entire financial year, the operating income of $1.25B was clearly much higher than the $502M in H1 2019, and even after taking the $542M of separation expenses incurred in H1 2019 out of the equation, the H1 2020 performance would still be much higher than in H1 2019 despite incurring close to $250M in restructuring expenses in the first half of this year.