Summary

- Celldex stock rose sharply after CDX-0159 data was announced in June.

- CDX-527 Phase 1 trial is now underway.

- Top line CD-3379 Phase 2 data should arrive before year-end.

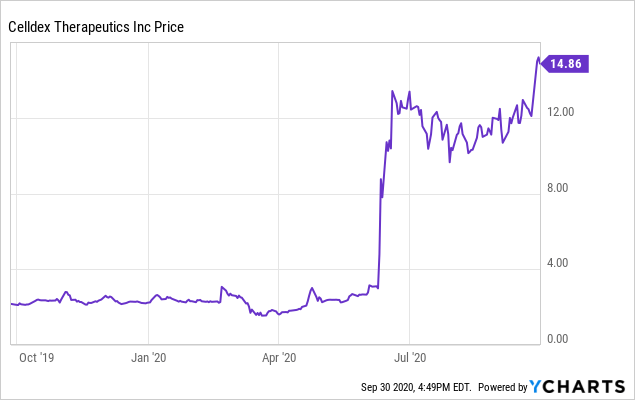

Celldex Therapeutics (CLDX) is a development-stage pharmaceutical company. It was once a high-flyer, before its lead candidate failed a Phase 3 trial in 2015. More recently, before the CDX-0159 news was announced in June, it was selling at about $3.00 per share. On September 30, 2020, Celldex closed at $14.83 per share, giving it a market capitalization of about $594 million.

This article will explore why investors have become so excited about Celldex in 2020. However, I cannot emphasize too much that while the stock still appears to be undervalued, true success will require a long process, ultimately getting FDA and EU approvals, then successful commercialization of at least one therapy.

Data by YCharts

Data by YChartsCDX-527

In late August, Celldex announced it had initiated a CDX-527 Phase 1 trial. CDX-527 is a bispecific antibody that targets both PD-1 and CD27. In preclinical models, it was more potent than PD-1 antibodies alone at T cell activation and resulting anti-tumor activity. It was also better than combining single-agent PD-1 and CD27 antibodies. The Phase 1 study will be open-label, of patients with advanced or metastatic solid tumors who have failed standard of care therapies. The plan is to enroll 90 patients. It will begin with a dose escalation phase. If that is successful at establishing a recommended dose, there will be expansion cohorts in specific tumor types, looking for safety and signs of efficacy. Other than the designation of solid tumors, the specific types of tumors to be studied have not been revealed. If CDX-527 does turn out to be more effective than current PD-1 agents, it could be a major revenue generator once it passes its trials and gets regulatory approval. Initial data from the Phase 1 study is anticipated in the first half of 2021.