Summary

- Q2 is seen by company's management as the worst quarter as the things started to improve at the end of the quarter.

- COVID-19 vaccine is planned to enter Stage III trials in September and be launched in Q1 21; JNJ ramps up to produce 1bn vaccines by the end of 2021.

- Stable Growth DCF model values JNJ at $155/share, however, successful vaccine launches might propel the share price to $160.

In its Q2 results presentation on July 16, Johnson & Johnson (JNJ) has improved its guidance for the year both on revenues and EPS, compared to April guidance. The company now expects to earn between $7.85-$8.05 in EPS on $81bn - $82.5bn of sales. The guidance increase comes from improved Medical Devices outlook. We believe JNJ has shown robust performance in COVID-19 environment and is poised for more growth.

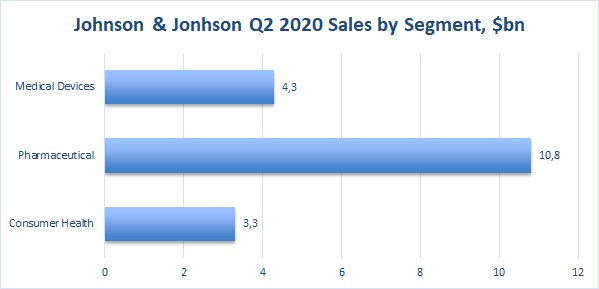

Johnson & Johnson has three major segments: Consumer Health, Pharmaceutical and Medical Devices. The impact of COVID-19 varied from segment to segment. Pharmaceutical sales, which is by far the largest segment, accounting for 60% of sales, posted slight growth in Q2. However, Medical Devices Sales saw a sharp 34% decline in the April-June quarter to $4.3bn from $6.5bn, followed by 7% decline in Consumer Health Sales. The latter, according to company's management, was caused by consumers stocking Consumer Health products in the first quarter of 2020.

Source: J&J Q2 2020 Earnings Presentation, author's graph

In Q2 2020 Johnson & Johnson saw a 38% decline in Adjusted EBIT to $5.3bn from $8.6bn in Q2 2019, due to the revenue drop in Medical Devices segment. This segment generated $3.7bn in Adjusted EBIT in Q2 last year with 57.5% adjusted EBIT margin, albeit $2bn were attributable to the divestiture of ASP business, and were an one-off event.