Summary

- Analysts have been boosting earnings and revenue forecast for Pfizer.

- There has recently been some option suggesting the shares rise.

- Additionally, the technical chart indicates higher price to comes.

- Looking for a helping hand in the market? Members of Reading The Markets get exclusive ideas and guidance to navigate any climate. Get started today »

Pfizer (NYSE:PFE) has undoubtedly been getting plenty of attention in recent months, with the potential for the company to make a coronavirus vaccine. It is well known that the company is partnering with BioNTech (NASDAQ:BNTX), to work on this vaccine.

A trader sees some positive news flow coming for Pfizer, betting that the stock will rise 7% by the middle of October. Additionally, the technical chart is suggesting that the stochastics rise as well. You can track all of my SA articles on this Google Spreadsheet.

Boosting Estimates

Pfizer stock has undoubtedly caught a sizable move higher, rising by more than 40% from its March lows. But that ride has been bumpy at best, with the shares plunging by as much as 19% in June. Even with the prospect of a vaccine, analysts do not see much benefit going to the company in 2020, with revenue forecast to fall by 4.3% to $49.5 billion.

However, the benefit is likely to come in 2021, with revenue forecast to rebound by 9.8% in 2021 to $54.3 billion. Analysts have been raising their revenue forecasts for the company as well. For example, on July 12, analysts had been forecasting revenue of $50.8 billion.

Earnings in 2020 are expected to be weak and fall by about 1% to $2.93 per share. However, those earnings are forecast to rebound by 13.9% in 2021 to $3.34 per share.

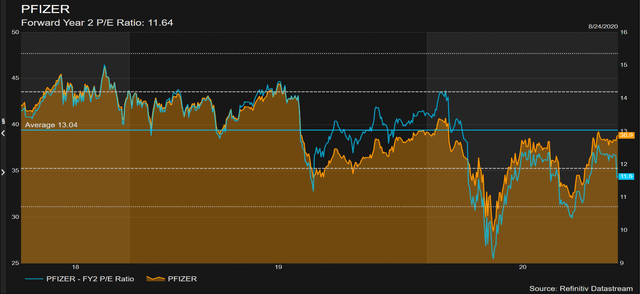

Even with the shares moving sharply higher in recent months, the stock trades at just 11.6 times next year's earnings estimates, which is at the low end of the historical range and below the average of 13.0 over the past two years.

Betting on Big Gains

The bullish outlook and favorable valuation are likely driving some traders to bet the shares continue to advance. On August 24, the open interest levels for the October 16 $40 strike price calls rose by 31,108 contracts. The options traded on the ASK and were bought for around $1.22 per contract. It implies that stock is trading around $41.25 or higher by the expiration date.