- PTC has continued to execute, and the company still showed modest sales growth despite the pandemic.

- Since my April article on the company, PTC has gotten risdiplam approved and acquired a late-stage therapy for PKU.

- Despite these advances and boosts to estimated revenue figures, PTC shares have declined and look like a good value at present.

I previously wrote about PTC Therapeutics (PTCT) on April 30, 2020. Since that time, the company has seen continued progress on multiple fronts, yet the share price has gone down presumably due to a growth rate slowdown caused by the COVID-19 pandemic. I considered PTC to be about fairly valued at the time of my last article, but I’m now somewhat bullish.

Recap Of My Prior Article on PTC

In my prior article, I focused on PTC’s business model and track record of adding new therapies and revenue to the company’s portfolio.

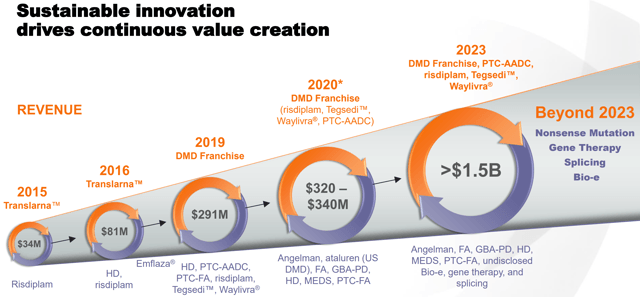

Figure 1: Chart showing PTC’s pipeline development and revenue growth (source: corporate presentation)

I talked about how revenues have gone up nearly 10-fold in the last 5 years and are projected by PTC to have another 5-fold increase over the next 3-4 years. This increase is expected to be from continued Emflaza and Translarna growth as well as newly approved products like risdiplam and PTC-AADC. Specifically, PTC had said the company expected to be getting over $400 million in revenue from gene therapies like PTC-AADC by 2023.

I also discussed the balance sheet and how PTC's debt and high cash burn made me think near-term dilution was likely, despite PTC having a decent amount of cash at the time. On top of a balance sheet that concerned me from a dilution standpoint, PTC was trading in the $50s which led to discounted future P/S ratios above the 5 level that I look for as an investment. This led me to say I was neutral on PTC’s outlook but would watch for any pullbacks or company progress because I really liked the company’s business model and trajectory.

PTC Has Since Continued To Add Value For Shareholders

Since that time, PTC has reported its numbers for both Q1 and Q2. PTC reported having $143 million in total product revenue in both quarters, which is only modestly up from the $139 million seen over the same time period last year. This is definitely a disappointment compared to expectations, but seeing any growth despite the difficult environment all companies are facing right now isn’t too bad. While $143 million in 6 months doesn’t annualize to the $320 million+ projected for this year, it still seems possible that PTC could hit its goal with continued growth and especially if conditions improve any later this year.

As you might expect from the overall revenue numbers, sales growth in PTC’s individual approved products was somewhat mixed. Emflaza continued to grow at a good pace, showing 30% year-over-year growth in Q2 to $36.2 million. Translarna took a sizable step back this past quarter but still had decent revenue in its 6th year post-launch, coming in at $38.6 million versus $57.8 million in the same period last year. With respect to Translarna in particular, it’s important to note that Brazil, a country with a very severe COVID-19 outbreak, is a big market. PTC has said it expects catch-up orders from groups in Brazil later this year that will backload a good amount of Translarna revenue.