Summary

- An AAA-rated company with a wonderful balance sheet makes buying its stock seem to be a very low risk investment.

- It is pointless to expect impressive growth from the dividend aristocrat. But I disagree that J&J will suffer too much from very high competition in the field of Covid-19 vaccination.

- The valuation is quite reasonable. Although I believe in Johnson & Johnson's long-term growth, I don't think its stock is particularly cheap right now.

Johnson & Johnson (NYSE:JNJ), one of the greatest and largest pharmaceutical companies in the world, is considered to be extremely low risk. As we all know, there are just two companies with a credit rating of AAA. These are Microsoft (NASDAQ:MSFT) and Johnson & Johnson. Although many stock market gurus warn that many corporate bankruptcies are ahead, it does not seem to be the case for Johnson & Johnson. But can the current valuations be justified? And what should investors expect?

JNJ stock dividend

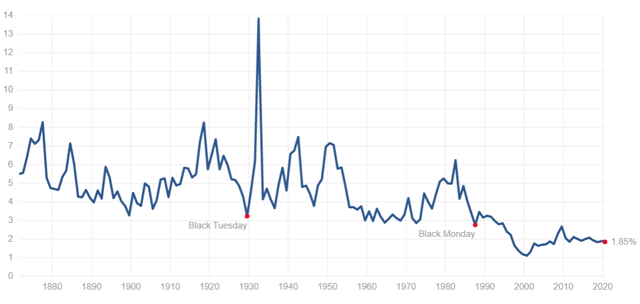

To start with, the current S&P 500 dividend yield of 1.85% is near record lows. In other words, it was only lower in 2000. That is not surprising. The corporate earnings are falling, whereas the stocks have rallied wildly since March.

S&P 500 dividend yield history

Source: Multpl.com

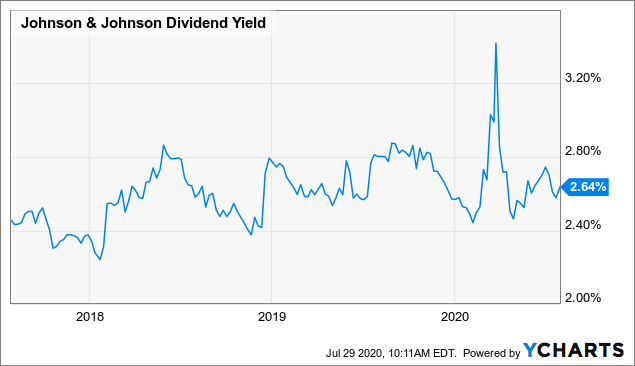

Data by YCharts

Data by YChartsSource: Y-Charts

But let's look at JNJ's dividend yield of 2.64%. It is quite a reasonable yield if you compare it to JNJ's earnings history. Compared to the benchmark's average, JNJ is even a dividend king, indeed. And it seems to be sustainable. JNJ has been raising its dividends for more than 50+ years. So, it seems that nothing could be better, given the current situation we are in. But how about the earnings growth potential and the valuation?