Summary

- Johnson & Johnson is a Dividend Champion with 58 consecutive years of dividend growth. Shares currently yield 2.87%.

- Johnson & Johnson is one of two AAA-rated companies, which suggests the quality and stability of the business is best of breed.

- Johnson & Johnson's current valuation looks attractive.

- Exploring potential put options to allow investors to purchase shares cheaper.

Johnson & Johnson (NYSE:JNJ) has long been a core holding for many investors seeking a stable business with solid growth, and of course, those that want dividends from their investments. While revenue growth isn't likely to return to >10% on an annual basis over a consistent stretch of years, that doesn't mean that Johnson & Johnson can't deliver solid returns for investors that hold over the long term. Consistent revenue growth in the mid-single digits should be achievable, which can still do wonders when purchased at sound valuations.

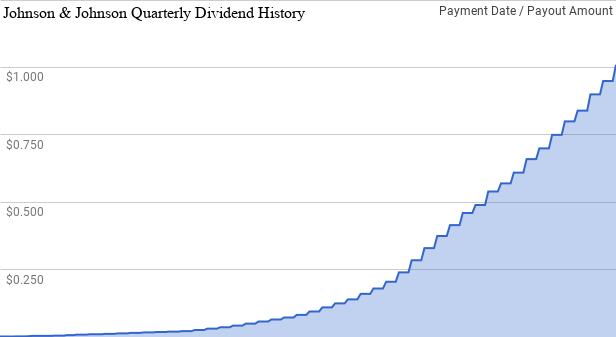

Dividend History

My primary investment strategy is dividend growth investing. By following the dividend growth strategy, the idea is to focus on business quality and buying at sound valuations, but ignore the day-to-day and month-to-month fluctuations in the share price.

Image by author; data source Johnson & Johnson Investor Relations

According to the CCC list, Johnson & Johnson is a Dividend Champion with 58 consecutive years of dividend growth. That's every year starting in 1963 that Johnson & Johnson has been there to reward owners with rising payments.

Johnson & Johnson's glory days of >10% annual dividend growth are likely behind it due to the fact that the business is a behemoth in the medical space rather than any deterioration in business quality.

The 1-, 3-, 5- and 10-year rolling dividend growth rates since 1973 can be found in the following table.