Summary

- The Upjohn split-off will be happening at some point in the second half of 2020, unhampered by COVID-19.

- Generics businesses command high margins, so even at lower multiples their valuations are significant, so we estimate the fair value of the Pfizer net of Upjohn.

- On the day of the split-off, we would not buy Pfizer if shares are not below $33.94.

- At that price, we think that Pfizer is an attractive income pick; if volatility allows entry at a lower price, we get the holy trinity of income, value and quality.

Pfizer (PFE) is an interesting company. Like most pharmaceutical players, they have superb operating margins and have been able to sustain their value creation even in the COVID-19 environment. Indeed, Pfizer has already recovered to pre-COVID highs. But still, Pfizer has an appealing capital allocation commitment. They have become more conservative in their M&A approach and we suspect that their main use of cash outside of organic reinvestment will be to support the ample and low-payout dividend. We are interested in their income proposition and potentially their value proposition, which will depend on the distortions that will be caused by the Upjohn split-off, a substantial and ambiguous corporate event.

(Source: investireoggi.it)

(Source: investireoggi.it)

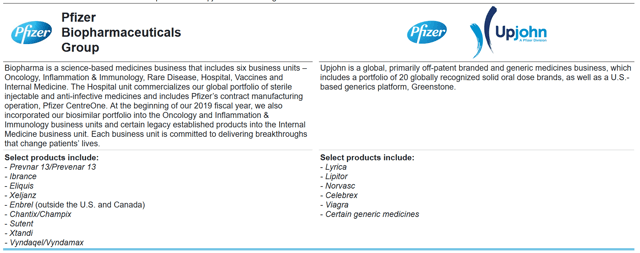

Upjohn-Mylan Merger

The Upjohn split-off is an important step in Pfizer's plans to become a more focused biopharmaceutical company similar to the likes of Regeneron (REGN) and Bristol-Myers Squibb (BMY). Within Upjohn are some of Pfizer's famous legacy but off-patent drugs like Viagra and Lipitor. What will remain with Pfizer are some of their more promising drugs in their oncology portfolio as well as their pediatric vaccines. Moreover, they will also continue to develop potential treatments and preventions for COVID-19, for which they thankfully receive little speculative premium as we'll demonstrate later.

(Source: 2019 PFE 10-K)

(Source: 2019 PFE 10-K)

Shareholders will receive shares of Upjohn until they are immediately merged with Mylan (MYL) to form Viatris, whereby Pfizer shareholders will be left with a 57% ownership in Viatris and Mylan shareholders will have 43%, reflecting the value-add of Upjohn's iconic portfolio as well as their tangibly higher margins. What's more is that Upjohn, once split, will raise $12 billion in debt, the proceeds of which will be returned to Pfizer, keeping their debt level at a reasonable ~2.4x Net Debt/EBITDA.

On the day of this split-off, in an efficient market, we should see a decrease in Pfizer's value inversely related to the value attributed by markets to the Upjohn shares. Because volatility breeds opportunity, we are going to wait to see how sharply Pfizer's business is repriced before we decide to buy. We are not interested in becoming involved in Viatris, as their volume procurement programmes, on which they substantially rely in emerging markets like China, creates a lot of operating volatility. We prefer the opportunity to get involved in a more value-add biopharma company with patented drugs on valuable platforms which the Pfizer biopharma segment provides.