Summary

- Johnson & Johnson has steadily performed during every economic cycle.

- The company has a AAA credit rating that ensures its viability in a variety of economic environments.

- Johnson & Johnson is finding ways to grow despite its massive size.

- The recent pullback gives investors a chance to add to or start a position.

Johnson & Johnson (JNJ) has been in my portfolio for the past few years as a blue chip heavyweight cornerstone type of investment. Despite being a mega cap company with over $82 billion in 2018 revenues, the company still manages to grow its top line every year. With the strongest credit rating available, shareholder-friendly management, and active portfolio management, the company will continue to grow revenues and profits. Investors should be able to continue to expect steady returns that will drive long-term capital appreciation to their investment. The recent share price drop due to the Coronavirus outbreak has given investors a chance to add to a position or start a position as the yield goes over a historically high 3%. The company will continue to perform well in any economic environment and is a great choice for worried investors.

Johnson & Johnson Steady As She Goes

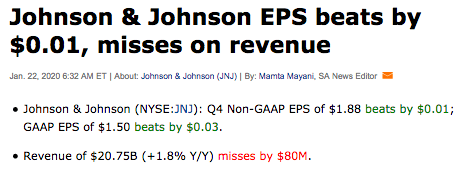

J&J has offered steady performance to investors for decades. While its large growth days are in the past, it still continues to grow its business. In the last quarter, JNJ beat on on the bottom and missed slightly on the top.

Source: Seeking Alpha

Source: Seeking Alpha

Though this miss is small in perspective to revenues. While revenue growth appears to be almost non-existent, it is important investors realize that it actually managed to grow revenue 2.6% in the quarter but was negatively impacted by currency headwinds. A company that operates globally like JNJ will often see this impact and it needs to be accounted for when reading headline earnings reports.