- Volatility has come from speculation around a potential COVID-19 vaccine.

- Positive vaccine data points could cause more spikes.

- Inovio's HPV cancer therapy and cancer vaccine pipeline are the main sources of long-term value.

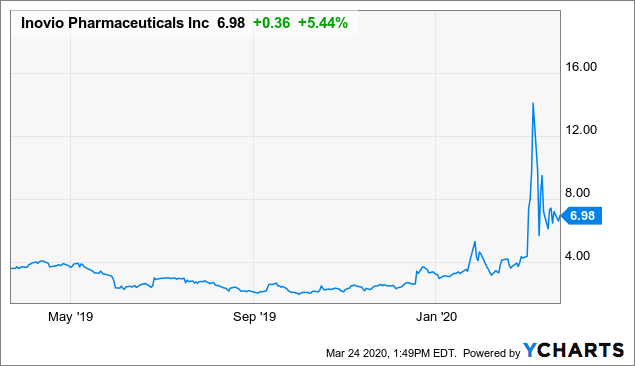

Perhaps you saw the 60 Minutes episode on Sunday, March 22 about Inovio Pharmaceuticals (INO) and its potential COVID-19 coronavirus vaccine. Well before that date, even before Inovio announced it was working on a vaccine, the stock price set off on a wild ride. Before looking at the likely longer-term value of the stock, I will review the recent ups and downs of the price. It is a good example of herd mentality in stock trading. Further down, I will give my opinion on the likely value of the vaccine and on the likely value of VGX-3100, Inovio's vaccine in an advanced trial to treat cervical dysplasia. VGX-3100 could generate top line results in Q4 2020. If you looked at Inovio for the coronavirus vaccine, you should stay in for VGX-3100 and the rest of its cancer vaccine pipeline.

By way of background, the 52-week low for Inovio is $1.92, while the 52-week high is $19.36. That is a factor of 10, within a single year. The closing price on March 23 was $6.62, down 8% for the day.

Data by YCharts

Data by YChartsAgenus Stock Price Ups And Downs

In 2012 and 2013, Inovio was mostly priced under $2.50 per share. In 2014, it spiked to near $15 per share. Inovio had a broad pipeline of vaccines against both infectious diseases and cancers. It puts DNA in plasmids that are inserted into the skin, resulting in protein generation that in turn invokes the immune system to create antibodies against the target. But time passed without any of the vaccines making it to commercial approval. This led to investor disappointment and the share price driving down to the $2.50 range for much of 2019. Another issue was the need to raise and burn cash to continue R&D efforts.

Back in December 2019, there was a bit of a spike, at least it looked spike-like at the time, because Inovio promoted the idea that it would concentrate its efforts on VGX-3100. That put the share price at over $3.00, a nice return if you had bought at $2.50 or lower earlier in the year. Reports on a Chinese mystery virus began circulating in December. On January 21, Inovio spiked 13% as one of several companies thought capable of making a coronavirus vaccine. On January 30, Inovio announced its plan, including that it received a $9 million grant from the Coalition for Epidemic Preparedness Innovations, or CEPI, resulting in another 12% spike, up to $4.66. The vaccine was named INO-4800.