Summary

- Johnson & Johnson is a multinational medical devices and pharmaceutical company.

- The company has a track record of healthy cash flows, shareholder-friendly dividend policy, sufficient liquidity and very little debt on its balance sheet.

- Valuation suggests that company’s shares are priced close to their intrinsic value and offer an attractive upside potential.

- Looking for a portfolio of ideas like this one? Members of Global Wealth Ideation get exclusive access to our model portfolio. Get started today »

Investment Thesis

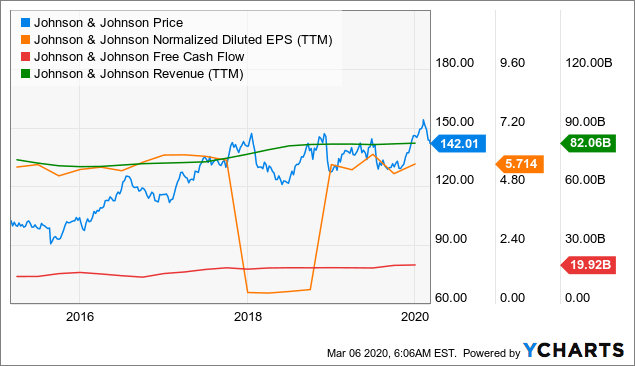

Over the past decade, the share price of Johnson & Johnson (JNJ) has been in a persistent gradual uptrend in line with the company’s continuous progress and impressive fundamental growth. With a steadfast M&A activity, new product introductions and overall positive business developments, the company’s shares trade at their intrinsic value and already imply a positive expected rate of return, which may increase further extend as the market sell-off continues.

Corporate profile

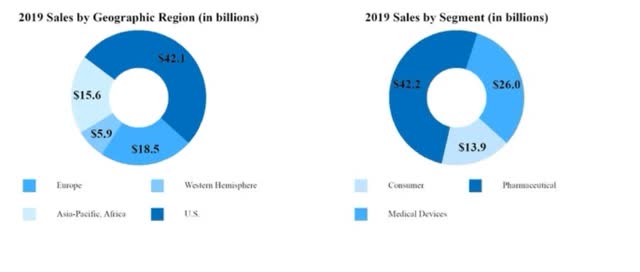

Johnson & Johnson is a multinational medical, pharmaceutical and consumer packaged goods holding company with its subsidiaries involved in research and development, manufacture and sale of a broad range of health care products, operating and conducting business virtually in all countries around the world. The company’s primary focus is human health and well-being related products and its credo is to put patients and people first. In 2019, the company had 132,000 employees and operated three distinct business segments: Consumer, Pharmaceutical and Medical Devices.

Source: 2019 10-K filing (Sales by segments and geography)

Source: 2019 10-K filing (Sales by segments and geography)

Key insights from the latest quarterly earnings call

Reading through the company’s latest quarterly earnings call transcript, the management recapped key financial statement changes, reported on performance of individual drugs and expressed confident outlook for the upcoming seasons.

"We reestablished our brand and purpose and made strategic decisions that over time will accelerate growth, reduce complexity and improve operating margins." – Alex Gorsky, Chairman & CEO

In Q4 FY2019, the company managed to successfully complete integration of several new businesses such as Zarbee Inc. (a leading company in naturally based over-the-counter remedies) and the Dr. Ci Labo (successful dermo cosmetic skin care business) and divest no longer synergical units (Babycenter). Despite the Medical Devices business line experiencing single-digit growth, the management praised the performance of existing surgery platforms and provided details of other critical product market launches from one of the fastest growing health care categories and exciting transformative field of medicine - digital surgery.