Summary

- YOY Pfizer is down on revenues and cash flow, stock price reflecting such.

- Guidance lowered for 2020, but operations becoming streamlined.

- Coronavirus fears affecting overall market and will continue to draw down share price.

- Strong dividend for pharmaceutical company that will continue payouts.

2019 Earnings

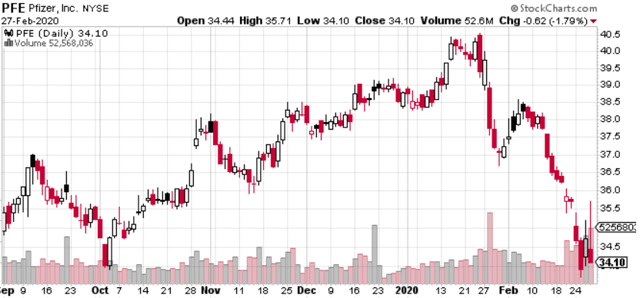

Pfizer (PFE) has fallen considerably over the last few months due to uncertainty of business and most recently a miss on Q4 earnings that has been a driving factor in the company's nearly 20% decline in share price since January 28 when they were released.

(Source: Stockcharts.com)

(Source: Stockcharts.com)

The adjusted earnings of $3.11 billion for Q4 were a bit off of estimates at $3.24 billion on revenues of $12.69 billion (-9.2% YOY). Losing exclusivity on critical drugs, Pfizer business took a major hit that is reflective of it.

Full year 2019 revenues dropped to $51.8 billion, reflecting a 1% operational decline represented through a 8% operational growth from Biopharma division countered by a 16% decline in operational revenues from Upjohn.

The key to focus on here is the growing Biopharma division that is remaining after the Upjohn spin-off with Mylan (MYL). With impressive growth and Pfizer now concentrating on the Biopharma business, the future is looking up.

2020 Guidance

The guidance provided by Pfizer has investors concerned. Loss of revenues in Upjohn and losing market exclusivity for Lyrica have had a detrimental effect on the share price.

Pfizer expects its adjusted earnings per share to be roughly $2.87 with guidance for the revenue is projected to be approximately $49.5 billion. However, the company is taking a more streamlined approach and focus towards the Biopharma division. The soft guidance is projecting a decline overall from the company's output, but it will be interesting to see how the new focus plays out over 2020.

Technical Analysis

(Source: Trading View)

(Source: Trading View)

At $35, the share price is sitting at a key level that has been in place for the past 2 years. The company has been trading in a fairly volatile range trending upwards since 2013, making 10%+ gains over weeks followed by losses. Recently, we saw a major market pullback and PFE drop below $33 for the first time in almost 2 years, signaling to me that a buy opportunity was upon us as the rest of the market was panicking. As Rothschild once said, "When there is blood in the streets, buy". The coronavirus really drove the overall market down, but with talks form the FDA it looks like biotech and pharma companies are starting to rally around Trumps want to push approvals forward.

Looking at the technical side of it, the MACD and bollinger bands are both signaling buys and move back upwards from $35. I am projecting a trend back up towards $38 in the next 3 months based off historic movement. Sitting at a price level that has had consolidation periods in the past two years indicates to me that the $35 level will continue to hold.