Summary

- Comcast has a track record of mostly high-single-digit EBITDA growth and double-digit EPS growth; its structural drivers remain intact.

- Cable Communications is connectivity-led, with highly resilient EBITDA growth and is relatively immune to disruption in the media industry.

- NBC Universal's size, content and customer reach means it is well-placed in upcoming “streaming wars”; it has done well during Netflix's rise.

- Sky has a history of strong profitability in the U.K. and could be a source substantial growth if Italy and Germany were to prove as successful.

- At $44.67, Comcast shares can grow EPS at 10%+ and deliver 10-15% in average annual shareholder returns. Buy.

- This article was selected to be shared with PRO+ Income subscribers - find out more here.

Introduction

Comcast (NASDAQ:CMCSA) has been one of our longstanding holdings, generating an approx. 80% gain since late 2014. We believe it continues to be a multi-year compounder with defensive qualities, with a 10-15% annual investor return.

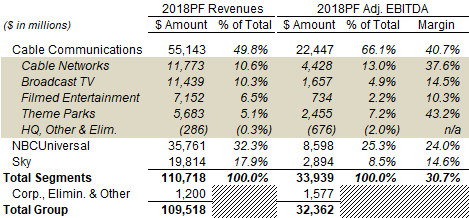

Comcast has 3 segments, with Cable Communications ("Cable Comms") the largest, generating two-thirds of EBITDA; approx. 75% of revenues are in the U.S.:

- Cable Comms – provides broadband, video, voice and other services to both residential households and businesses in the U.S.

- NBC Universal ("NBCU") – a global media business operating cable networks, broadcast TV, film studios and theme parks

- Sky – a European business that provides broadband and telecom services in the U.K., Italy and Germany, and media content; acquired in 2018

Peers include Charter (CHTR) and Altice USA (ATUS).

Comcast Revenues & EBITDA Breakdown (2018 Pro Forma) NB. Sky impacted by $231m of contract termination & settlement costs. NB. Sky impacted by $231m of contract termination & settlement costs.Source: Comcast results release (18Q4). |

Consistent High-Single-Digit EBITDA Growth

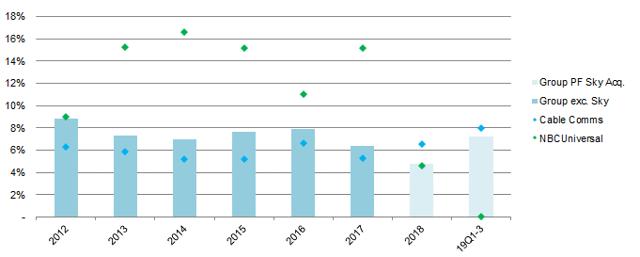

Comcast has a track record of growing EBITDA at high-single-digits (6-8%) in all but one year since 2012, the result of Cable Comms EBITDA growing at 5% or higher and NBCU EBITDA growing at double-digits until 2018:

Comcast EBITDA Growth – Group, Cable Comms & NBCU (Since 2012) NB. 2012 group EBITDA growth is as reported, but NBCU EBITDA growth is pro forma (NBCU acquired Jan-11). Source: Comcast filings. NB. 2012 group EBITDA growth is as reported, but NBCU EBITDA growth is pro forma (NBCU acquired Jan-11). Source: Comcast filings. |

Comcast's high-single-digit EBITDA growth has led to double-digit EPS growth in 9 out of the last 10 years (2016 being the exception, with 7.1%), helped by natural financial leverage and share buybacks.

We believe the growth drivers for both Cable Comms and NBCU remain intact, and Sky (acquired in October 2018) provides a source of additional growth. As explained below, Cable Comms should grow EBITDA at high-single digits, and NBCU at mid-to-high single digits, while Sky EBITDA should be stable/growing, leading to group EBITDA growth at mid-to-high single digits.