Summary

- Honeywell International (HON) has continued to see growth in the most recent quarter.

- Margin growth in the Aerospace segment has been particularly impressive.

- I expect further upside from here.

At the beginning of last month, I made the argument that Honeywell International (HON) is likely too expensive at a price of $164 (where the stock was trading at the time).

Specifically, I made the argument that an investor should be seeing a significant increase in free cash flow to justify investment at such a price. Otherwise, an investment at the $140-150 range would be more reasonable.

At the time of writing, Honeywell International is trading at a price of $173:

Source: investing.com

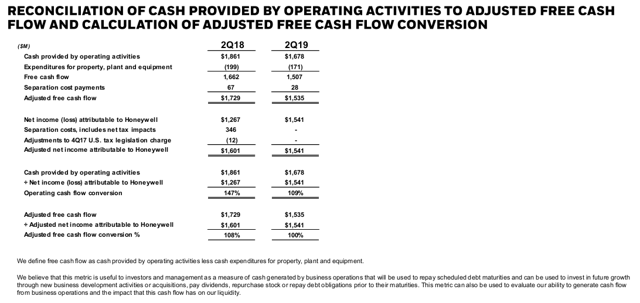

Clearly, the stock's growth has exceeded my prior expectations. What is particularly interesting is that when taking into account the company's recent performance in the most recent quarter, we can see that free cash flow growth has actually dropped from that of the previous year, with adjusted free cash flow conversion also having fallen slightly:

Source: Honeywell Second Quarter 2019 Earnings Release

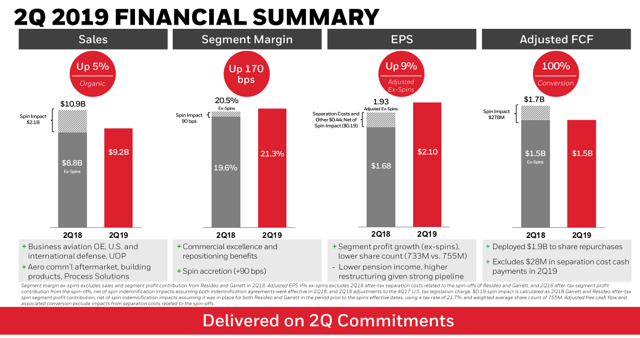

With this being said, the company has continued to grow, with sales and EPS up by 5% and 9% respectively: