Summary

- HON reports earnings Thursday.

- If we are at peak economy, then HON's growth story defies logic.

- At over 17x run-rate EBITDA, HON appears overvalued.

- Sell HON.

- This idea was discussed in more depth with members of my private investing community, Shocking The Street. Get started today »

Honeywell (HON) reports quarterly earnings July 18th. Analysts expectrevenue of $9.35 billion and EPS of $2.08. The revenue estimate implies 5% growth sequentially. Investors should focus on the following key items:

Is The Growth Story Real?

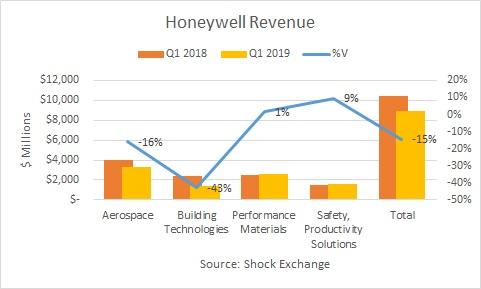

Bulls seem to fancy HON as a growth stock. Parsing through its earnings fundamentals requires an understanding of the economy and company specific issues. After trillions in stimulus from central bankers, the global economy has to peak at some point. If we are at peak economy, then industrial names like Honeywell may have seen their best days. In Q1 2019, Honeywell's revenue fell 15% Y/Y. Aerospace and Building Materials were hit hard, experiencing double-digit revenue declines.

The company has been hiving off underperforming assets and becoming more strategically focused. Last year, the company spun off thermostat maker Resideo Technologies (REZI) and turbo charger maker Garrett Motion (GTX). The divestitures triggered the revenue decline.

However, Honeywell's organic sales were strong. Aerospace generated 10% organic revenue growth on the strength of aviation and defense orders. Given the strength of commercial air travel and President Trump's emphasis on defense spending, this segment could show strength for several more quarters. This is important, as Aerospace represents Honeywell's largest segment at 38% of total revenue. Organic revenue growth from Building Technologies, Performance Materials ("PMT") and Safety, Production and Solutions ("SPS") was 9%, 5% and 10%, respectively.

Given the noise created by asset sales, revenue growth sequentially could also be important. The company's revenue growth Q/Q was also off by 9%. Building Technologies revenue fell 23%, while every other segment reported a Q/Q revenue decline in the single-digit range. The revenue estimate for Q2 implies 5% growth Q/Q. I anticipate a big quarter from Aerospace. SPS could report strong growth from the Internet of Things ("IoT") and industrial automation. I remain skeptical on where the other areas of growth will come from.