Summary

- Honeywell reported strong Q1 2019 results that beat the top- and bottom-line estimates. Management also raised its full-year 2019 guidance.

- Additionally, Honeywell's margin profile is a key component of the bull case. So it is encouraging that the company's operating margin was over 20% again this past quarter.

- I am long Honeywell and I plan to stay long the stock.

- This idea was discussed in more depth with members of my private investing community, Going Long With W.G.. Start your free trial today »

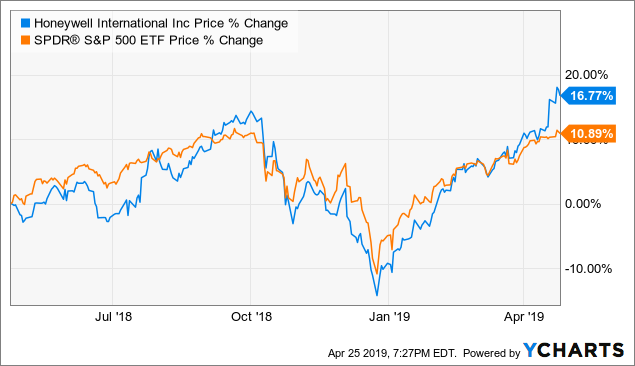

Honeywell's (HON) stock has outperformed the broader market by almost 6 percentage points over the last year.

Data by YCharts

Data by YChartsIn addition, HON shares are higher by ~28% so far in 2019 and, in my opinion, the stock still has room to run. As I previously described, the recent spinoffs - Garrett Motion (NYSE:GTX) and Resideo (REZI) - have Honeywell better positioned for the future and I believe that the company's most recent operating results show that there is a lot to like about this industrial conglomerate in today's environment. More specifically, Honeywell's margin profile makes the stock a great long-term buy even at current levels.