Summary

Teva Pharmaceuticals just reported strong earnings.

The company's restructuring is progressing according to plan.

Bleeding on Copaxone looks like it has slowed down to a trickle.

EPS and EBITDA should improve here on out.

Looking for more? I update all of my investing ideas and strategies to members of Special Situation Report. Start your free trial today »

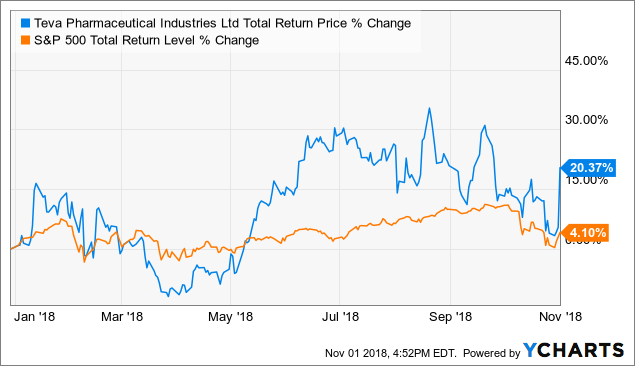

Teva Pharmaceuticals (NYSE:TEVA) just held another earnings call. It's one of Warren Buffett's holdings. How can I not keep an eye on it, right? I've never quite pulled the trigger on it. Those who did are up big in 2018:

TEVA Total Return Price data by YCharts

TEVA Total Return Price data by YChartsMy reasoning for missing out here has been the valuation level, generics business and turnaround situation, combined with a heavy debt load. I'm not shy about venturing into tough situations. Call me an idiot, but I did write up Bausch Health (NYSE:BHC) for subscribers back in August 2017, which was in a similar situation but with much more hair (and more attractive valuation as a consequence):