Summary

Campbell Soup Company is down after wrapping up its fiscal 2018 with another revenue miss that included a decrease in organic sales of 3%.

Management outlines its agenda to turn the company in a direction that includes higher margins, and growth.

These initiatives will take quite a bit of time to come to fruition, and the company will continue to face headwinds in the near term.

Because of this, the stock should continue to be avoided.

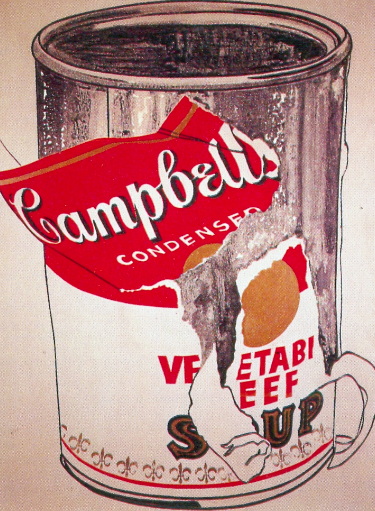

Back in May of last year, shares of soup icon Campbell Soup Company (CPB) were trading near $63 per share. I made a call that shares were massively overvalued. Since then, the stock price has eroded down to as low as $32.63 per share over the past year. Management wrapped up its fiscal year with Q4 earnings on Thursday. The quarter included a revenue miss, and organic sales that decreased 3%. Management has unveiled some new directives, as it's clear a shake up is needed. Now trading at just over $39 per share, it's time for investors to revisit the company to determine if there is upward potential in a stock that has become very unpopular with the market.

source: Pinterest