Summary

Honeywell International has shown very impressive free cash flow growth.

The company could see upside to $225-230 on a free cash flow basis.

I take a bullish view on this stock.

Investment Thesis: Honeywell International (HON) could see upside to the $225-230 level based on an expected 20% annual growth in free cash flow.

Back in my last article on Honeywell International, I expressed the possibility that aerospace tariffs could adversely affect the company’s performance ahead of Q2 earnings. Moreover, I cautioned that the upcoming earnings report would be a significant telling point as to whether this company can continue to grow.

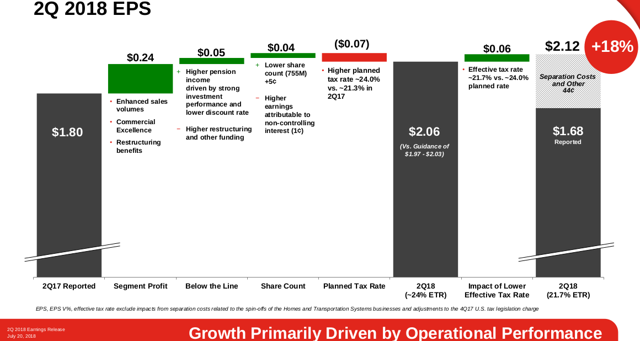

However, earnings growth was quite impressive for Q2, up by 18% from Q2 2017 to $2.12 per share (including separation costs).

In particular, Aero sales were particularly impressive, with organic sales up by 8% along with a margin change of 22.6%: