Summary

PPG Industries is buying itself, instead of buying Akzo Nobel.

Unlike Unilever's buyback program, PPG's repurchase program does make sense, as it's buying back stock at an attractive valuation.

Paint and coatings producers are cyclical stocks, so a cheaper valuation doesn't mean a company is cheap.

This idea was discussed in more depth with members of my private investing community, European Small-Cap Ideas.

Introduction

PPG Industries (PPG) is one of the largest paint and coatings producers in the world, and although this is a relatively cyclical business, PPG could be an interesting company for investors with an ultra long investment horizon. Economic cycles don’t last forever, and when one of the downcycles ends, there’s always a higher demand for paint, either from the industrial coatings side, or the performance coatings side.

[object HTMLElement]

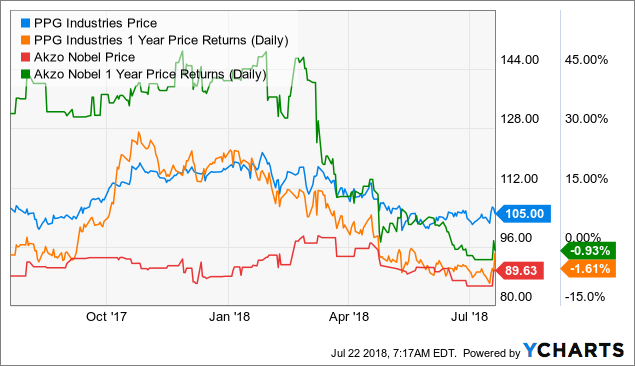

As PPG reported a substantial revenue increase and should be able to benefit from the new (lower) US corporate tax rate, the company appears to be priced rather attractively right now.