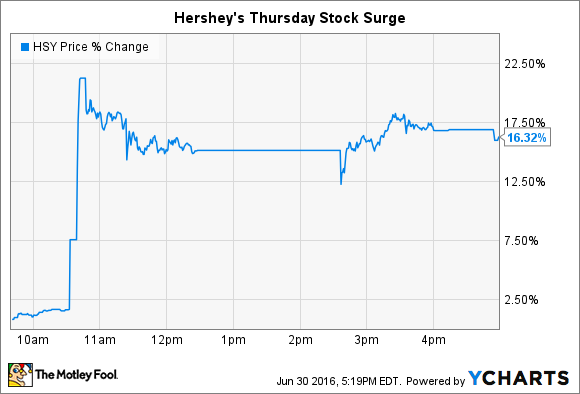

Hershey (NYSE:HSY) investors got a sweet surprise on Thursday, as their stock leapt to an all-time high on takeover news. Mondelez(NASDAQ:MDLZ), owner of the Oreo, Nabisco, and Cadbury brands, sent an offer to Hershey valuing the company at $107 per share, or $23 billion. That translates to a 10% premium over Wednesday's closing price.

Hershey immediately shot down the merger idea, but that's likely not the end of this story.

Hershey's management sounded unimpressed by Mondelez' opening move. In fact, the board of directors "unanimously rejected the indication of interest, and determined that it provided no basis for further discussion," they explained in a press release. Hershey described the terms as preliminary, non-binding, and including a mix of cash and stock payment.

Hershey's stock spiked far above the $107 per-share offer price, though, suggesting that investors believe higher bids are on the way, either from Mondelez, or from rival snack food and candy giants.

The prospects for a merger

There are some good reasons to believe that the bidding isn't over yet. For one, The Wall Street Journal, which cited inside sources in its reporting of the proposal, described Mondelez as eager to make a deal that would allow it to leapfrog Mars to become the world's biggest candy company. Mondelez' stock rose 6%, indicating that investors see real benefits in that potential tie-up. Chief among these would be increased probability, as Hershey's 45% profit margin trounces Mondelez' 39%.

Second, the proposal could bring competing bids from rivals who've been eyeing Hershey's business, or would rather keep it out of Mondelez' control.

Hershey immediately shot down the merger idea, but that's likely not the end of this story.

Hershey's management sounded unimpressed by Mondelez' opening move. In fact, the board of directors "unanimously rejected the indication of interest, and determined that it provided no basis for further discussion," they explained in a press release. Hershey described the terms as preliminary, non-binding, and including a mix of cash and stock payment.

Hershey's stock spiked far above the $107 per-share offer price, though, suggesting that investors believe higher bids are on the way, either from Mondelez, or from rival snack food and candy giants.

The prospects for a merger

There are some good reasons to believe that the bidding isn't over yet. For one, The Wall Street Journal, which cited inside sources in its reporting of the proposal, described Mondelez as eager to make a deal that would allow it to leapfrog Mars to become the world's biggest candy company. Mondelez' stock rose 6%, indicating that investors see real benefits in that potential tie-up. Chief among these would be increased probability, as Hershey's 45% profit margin trounces Mondelez' 39%.

Second, the proposal could bring competing bids from rivals who've been eyeing Hershey's business, or would rather keep it out of Mondelez' control.